So you are thinking about buying a home…. There are many different types of mortgages to choose from. Let’s explore which loan is best for you….

There are many different factors to consider when choosing a mortgage. .

We need to determine what type of property you are looking to buy. Are you looking to buy your first home? Are you looking to upgrade your current home? Are you looking for a vacation home? Or are you looking to get into investment property?

Other factors to consider are the price of the home, down payment amount and your credit score. These items will all be factors for choosing the correct mortgage.

First, let’s take a look at the most common mortgages available:

- Conventional Mortgage loans

- Jumbo Mortgage Loans

- Government Mortgage Loans

- Specialty Mortgage Loans

Conventional Mortgages

A conventional loan is any mortgage loan that is not insured or guaranteed by the government.

Conventional loans are considered one of the most popular loans. These loans are for people with good credit. Conventional loans can be used to buy primary homes, secondary homes, or investment properties.

These loans will need a credit score over 620. These loans will require documentation to verify your income (employment), assets, and down payment source.

These loans usually have some of the best terms available.

Conventional loan terms are usually a fixed interest rate. This means that the interest rate stays the same throughout the life of the loan. You can find these available in 15-year or 30-year terms. You can sometimes find lenders who will offer terms for 8-year 10-year, or 20-year notes.

The alternative to a fixed-rate loan is an adjustable-rate mortgage. This is commonly known as an ARM.

An ARM will typically offer 3-year, 5-year, and 7-year adjustable rates. This means that the rate will stay fixed for the 3-year, 5-year, or 7-year term. Then the rate will fluctuate every 6 months to match the current going interest rates. This interest rate is usually lower than the going fixed rate loan.

ARMs are a great product if you only intend to keep the property for a short period of time. If you intend to keep the property longer, you will try and wait for the interest rates to decrease. Then refinance into a fixed-rate loan.

Jumbo Mortgages

A Jumbo Loan (in 2022) refers to any loan over $647,200 in most parts of the country and $970,800 for the high-cost areas of the country. These loans allow a buyer to finance a high-dollar property.

Interest rates tend to be competitive with conventional loans. It is not unusual to see interest rates a little higher. The reason that rates are higher is due to the increased risk for the lender.

Jumbo loans are going to require a credit score over 700. Lenders will want to see extensive financial documentation. They will want to see proof of cash and assets.

Government Mortgages

There are 3 different types of Government loans:

- FHA Mortgage Loans

- VA Mortgage Loans

- USDA Mortgage Loans

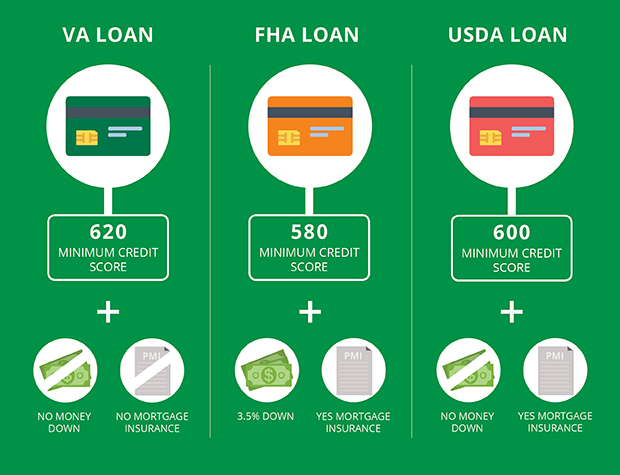

FHA Mortgages Loans

FHA loans are loans that are backed by the Federal Housing Administration. The FHA is part of HUD. HUD stands for the Department of Housing and Urban Development. HUD was founded in 1965. The main goal was to improve affordable home ownership. Check out the HUD site for more info.

These loans can only be used for primary home purchases.

These loans will allow for seller paid closing costs. This means that you can roll the closing costs into the purchase price.

These loans are great for people with a little down payment. You can go as low as 3.5% down.

These loans also allow for a lower credit score. Your credit score will need to be between 500 and 580, depending on your down payment.

You will have to pay for mortgage insurance premium (MIP) on all FHA loans. This insurance protects the lender in case you were to default on the loan.

The FHA will need to approve the property that you wish to buy. All contracts to purchase will require you to state that you intend to do an FHA Loan.

USDA Mortgage Loans

USDA Loans are available to help people purchase property in rural areas. These loans are available by the U.S. Department of Agriculture Mortgage Program. Check out the USDA site for detailed information.

These loans can only be used to buy a primary home.

A USDA loan does not require a down payment. This loan is similar to an FHA loan because it requires a Mortgage Insurance Premium (MIP). These loans also offer low interest rates.

USDA loans allow for the seller to contribute to the buyers closing costs.

The property will need approval by the USDA.

VA Mortgage Loans

VA Loans are for members of our military that have served 181 days of active duty during peacetime, served 90 consecutive days during wartime, or served more than 6 years with the National Guard or Reserves. Check out the VA site for detailed information.

These loans do not require a down payment or mortgage insurance. There are fees associated with using this type of loan.

VA Loans allow for the seller of the property to contribute to closing costs.

Specialty Mortgage Loans

Construction Loans

Construction Loans are used when you plan to build a home. This loan is typically interest only until the home is complete. When completed you would use one of the above loans for the final loan. You can usually find loans called construction to permanent loans. Where you have a one time close. Basically both loans are wrapped into one loan.

Interest Only Loans

Interest Only Loans are loans where you are only paying for interest. These are typically used when someone plans to sell the property quickly. These tend to be popular with house flippers.

Reverse Mortgages

Reverse Mortgages are loans for seniors over the age of 62. This allows people to cash out the equity that they have in their home.

After you have read over the different types of mortgages, it’s time to analyze what works for you. I highly recommend working with a local lender or mortgage specialist in your area. They can review your financials and help you figure out which loan works best for. If you are unsure about how to find a good lender, be sure to check with your realtor. They can help you with finding the right lender. This is one of the reasons that I recommend hiring a realtor. They are so important in the home buying process Be sure to check out my blog post about reasons to hire a realtor.