Most people dream of owning a home. You work hard to buy your first home…and then you eventually end up in your forever home.

You worked so hard to get to this point. It’s like a dream come true.

Then all you can dream of is paying off the mortgage. But how in the world do you get to that point?

I’m going to give you 4 easy ways to pay off your mortgage early.

Now you’re thinking there is no way that I could pay off that mortgage. It’s huge!!!

The amount seems overwhelming. It’s much easier than you think.

What are the benefits of paying off my mortgage early?

First of all, less stress. Knowing that your home is paid for is total peace of mind.

You own your home free and clear. Few people can say that.

Most people never pay off their homes. In the US only 38% of homes are mortgage free.

The next benefit is saving on interest. Have you ever looked at how much interest you pay the bank over the life of your loan? Check out this great video about how mortgage interest works.

You could do so much more with that money!!!

Once you have paid off your mortgage…. you can start putting that money into a retirement account or investment account. Watch your money grow.

Your quality of life improves. You now have more freedom. More financial choices than when you were saddled with a mortgage.

So now let’s take a look at how to make this happen…..

Bi-Weekly Payment

The first way to pay off your mortgage early is by making bi-weekly payments.

Bi-weekly payments are when you pay half of your mortgage every 2 weeks. This will mean that you end up making one extra payment a year on your mortgage.

This can take years off your mortgage. Check out this bi-weekly mortgage calculator.

This not only takes time off your mortgage, but it also saves you money on interest.

Another bonus to making bi-weekly mortgage payments is sinking this up with your bi-weekly paycheck. This helps people budget their money better.

See how easy this can be!!!

Please note** You must talk to your bank or mortgage lender to make sure that they will allow this type of payment system. Be sure to read the fine print of your mortgage.

Extra Principal Payment

Another easy way to pay off your mortgage early is by putting extra money towards your principal every month.

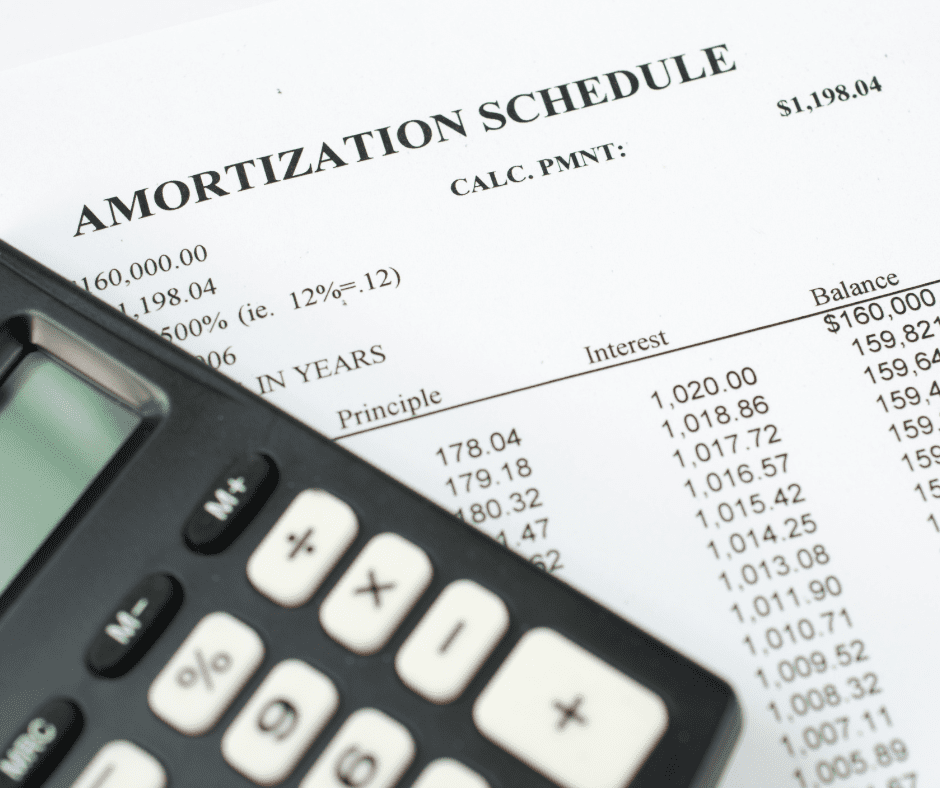

If you don’t already know, your mortgage payment consists of principal and interest. A portion of your payment goes toward paying off the principal of the loan. The other portion of the payment goes toward the interest that the bank charges.

I personally have been using this method. I make this happen by budgeting extra money every month and putting it towards the principal of my loan.

You would be shocked at how a little extra can shave years off your mortgage. Check out this article about loan amortization.

If you aren’t working with a monthly budget, please check out my post about the 50/30/20 Budget Rule. It’s how I plan out my money.

As always, be sure to check with your bank or mortgage lender. Make sure that they will allow extra principal payments. Always read the fine print of your mortgage. All loans are different.

Refinance

Another way to pay off your mortgage early is by refinancing your loan. This option has been very popular in the last couple of years.

The reason this option was popular is that interest rates were so low. That is not the case right now. Interest rates have almost doubled.

But don’t worry, these rates are still historically low. I’ve been in real estate for over 20 years and have seen interest rates close to 10%.

It may still be a good time to refinance your loan. You may be looking to take your 30 year note down to a 15 year note. This can save you thousands in interest.

Be sure to weigh the cost of refinancing with the potential interest savings.

Recast Loan

Most people have never heard of recasting their loan. Recasting is a great alternative to refinancing.

This option will work best for someone that has come into a large sum of money. This money could come from inheritance or work bonus. Some sort of a windfall.

You have decided to use this large sum of money to pay down the principal of your loan.

You will go to your bank and ask them to recast your loan.

They will put the large sum of money towards your principal. They will then recalculate your monthly payments.

You avoid the cost of refinancing your loan. You will keep your current interest rate.

This has great advantages:

- No closing costs

- No credit check

- No mortgage application

But how does this help me pay off my loan early? You simply keep putting the same amount towards your mortgage every month. Your mortgage will be paid off in no time.

Now before you start implementing one of these payoff plans, please be sure to make sure that your finances are in order.

I recommend that you are debt free.

I recommend that you have eliminated car loans, student loans, credit card debts, and more. These types of loans will typically have higher interest rates.

You want to pay off high-interest rate loans first. Otherwise, you aren’t making financial progress.

Hopefully this gets you on the path to financial freedom. Be sure that you are always contributing to your savings and investments as usual.

And once you have paid off your mortgage, make a plan to put that extra money towards investments.

Cheers to being mortgage free!!!